Prequisites

To use this indicator you should have available the following prequisites

- Quantower trading platform at least version v1.141.19. Click to Download the platform

- Free Quantower License. Click Here to get one

- automated-trading.ch Account with Premium Subscription

We highly recommend joining our discord community by following this invite link

![]()

Description

The ICT Concepts Quantower is a premium indicator which displays key concepts of the ICT trading methodology and style. Those key concepts are the following:

- Change of strucutre (or Change of Character or Market Structure Shift) that indicates that the trend might change

- Break of Strucutre (or Market Structure Break) that indicates a continuation of the trend

- Faire Value Gaps which represent displacements of price and are defined as instances of inefficiencies or imbalances visualized by three consecutive candles containing one large middle candle whose bordering candles' upper and lower wicks do not overlap.

- Order Blocks which represent crucial support and resistance levels derived from aggresive price movement, and that can be used as entry or exit levels

- NWOG (New Week Opening Gap) which is the price gap between Friday's closing price and Sunday's opening price

- NDOG (New Day Opening Gap) which is the price gap between yesterday's closing price and Today's opening price

- RTHG (Opening Range Gap) which marks the distance between the first opening tick of a session and the previous session's close

Examples

Change of Character (Market Structure Shift) and Break of Structure

The market structure features of the indicator allows to draw the market structure shifts and break of structures. Market structure shifts are price breakouts indicating a probability of price changing dirction. On the other hand, Break of structure are price breakouts indicating a trend direction continuation. Those market structure events are building blocks of the ICT methodology and can be used as bias determinants and filters to go long or short.

Fair Value Gaps

In this example, the indicator detects several Fair Value Gaps on the NQ instrument on a 5 Minutes Timeframe. Coupled with MSS and MSB, FVGs can be a very good signal to enter a trade.

In this example, bullish FVGs are drawn in green, and bearish FVGs are drawn in red. Their drawing is stopped when they are mitigated.

One example entry setup is illustrated on the image above. After a bearish BOS (Break of Structure) has been detected on the first red arrow, we can see a clear rejection of the price from a Bearish FVG where the arrow marked "Enter", this is a strong signal to enter short.

FVGs can also be used as an exit signal, an inverse FVG (iFVG) that occured on the arrow marked "Exit" is a strong signal to exit the trade. an inverse FVG is a FVG that gets broken on the inverse of its direction

Order Blocks

Order Blocks are defined as zones created from the last high swing candle (for bearish) or the last low swing candle (for bullish) before a Market Structure Shift or a Break of Structure. Add to this some other rules:

- The candle defining the Order Block should be followed by an FVG

- The Order Block zone should not be mitigated before the breakout creating the Market Structure event (this can be enabled/disabled as a parameter)

On this orderblock example, we can observe a bearish change of character followed by a bearish break of structure. The BOS was the trigger to create the bearish Order Block at the second marked arrow. Then the price retraced upward into revisiting the order block from below, at thethird marked arrow the price was rejected from the order block, this is a strong bearish signal that can generate a short trade.

NDOG (New Day Opening Gap)

The New Day Opening Gap (NDOG) is defined by (ICT) as the separation in time/price that is caused by the 1-hour break that occurs each day in the futures market. The opening price of the gap is the very first tick that occurs at the 6:00pm [UTC-4] restart. then we look at the 5:00pm closing price of the previous session. These gaps can be draws on liquidity as well as general reference points to determine daily bias

NWOG (New Week Opening Gap)

The NWOG is the gap between Friday's closing price and Sunday's opening price. These gaps can be draws on liquidity as well as general reference points to determine weekly bias

RTH Gap (Opening Range Gap)

The Opening Range Gap, also known as the Regular Trading Hours (RTH) Gap, is the distance between the first opening tick of a session and the previous session's close, when looking at a chart's Regular Trading Hours (not to be confused with Electronic Trading Hours). This gap is an important element for Futures Market traders that follow the works of The Inner Circle Trader (ICT). To be more specific, the Opening Range Gap occurs between 4:15pm [UTC-4] and 9:30am of the next day.

Features

The ICT Concepts indicator has a set of unique features

- Can play a sound alert on each ICT zone (FVG, Order Blocks, ChoCh, BoS)

- Can be run on any time-based or price-based Chart

- Active development and constantly adding new features

Parameters

We always try to keep the parameters to minimum.

| License | |

| License | This is the license key you get when you create an account on automated-trading.ch. After creating an account, copy your license key from the billing page. You need to set this parameter only once, once the license key is validated it will be remembered. |

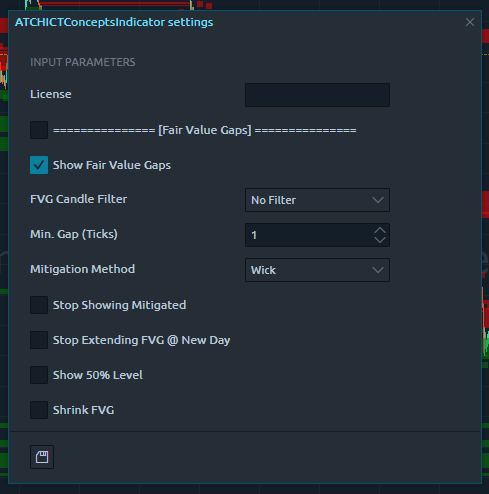

| Fair Value Gaps | |

| Show Fair Value Gaps | This will enable/disable drawing of Fair Value Gaps |

| FVG Candle Filter | This parameter sets a filter for the FVG detection :

|

| Min. Gap (ticks) | This parameter sets the minimum distance in ticks between the wicks of the Fair Value Gap to be valid. The more you increase this value, the fewer FVGs will be detected. Inversly, the more you decrease this value, the more it increases the number of detected FVGs |

| Mitigation Method |

When price hits the FVG after its formation, it is said to be "mitigated" and it stops from further extending. This parameter allows to chose which

mitigation method is used to set whether an FVG is considered mitigated by the price:

|

| Stop Showing Mitigated | This parameter will hide FVG drawing once they are mitigiated allowing for a more clean chart |

| Stop Extending FVG @ New Day | This parameter will make the FVG zone drawing stop from extending into a new day. |

| Show 50% Level | This parameter will draw consequent encroachment (50%) on the FVG zone |

| Bullish Color | The Brush color to draw bullish FVGs |

| Bearish Color | The Brush color to draw bearish FVGs |

| FVG Render Opacity (1-100) | The Brush opacity to draw FVGs |

| Show FVG Label | Enable/disable showing the label on each FVG |

| This section is used only when the Show FVG Label parameter is enabled | |

| FVG Label Size | FVG label Text Size to be drawn |

| FVG Label Color | FVG label Color |

| FVG Label Opacity (1-100) | FVG label Opacity |

| Play Sound when FVG is created | This parameter will enable playing and alert sound when an FVG is created |

| Play Sound when FVG is mitigated | This parameter will enable playing and alert sound when an FVG is mitigated. Useful if you want to trade FVG pullbacks |

| Play Sound File FVG | This parameter will set the file name to be played on sound alert if enabled. This can be set to any .wav file on your computer |

| Market Structure | |

| Swing Period | Swings are higher lows,higher highs, lower highs and lower lows. After each price bar close, a swing can be detected. But just after that, the next bar can cancel the swing at the previous bar by creating a new swing of the same type. Or this can happen on the second bar, or the third, etc... The swing period sets how many bars is enough to seperate two swings of the same type. The more you increase this parameter, the more you decrease the number of swings overall. The more you decrease this parameter, the more you increase the number of overall swings. I personally use the value of 3 or 4 for this parameter. |

| Show Price Swings | This parameter will enable/disable drawing a mark below/above swing price points. This is useful if you want to see how market structure is analyzed since those swing points are the building blocks of the indicator algorithme. |

| Swing Bullish Color | This sets the color brush of the low swing points |

| Swing Bearish Color | This sets the color brush of the high swing points |

| Swing Opacity (1-100) | This sets the opacity of the swing points drawing. The value of 0 is trasparent, and the value of 100 is full opaque |

| Show ChoCh (MSS) | This will enable/disable drawing of Change of Characters or also known as Market Structure Shifts |

| MSS Bullish Color | The color brush of bullish MSS |

| MSS Bearish Color | The color brush of bearish MSS |

| MSS LineStyle | Line Style to draw MSS line |

| Show Choch (MSS) Label | this parameter enables showing a label text on each MSS on the chart |

| Show Break of Structure | This will enable/disable drawing of Break of Strucutres |

| BOS bullish Color | The color brush of bullish Break of Structure drawings on the chart |

| BOS bearish Color | The color brush of bearish Break of Structure drawings on the chart |

| BOS LineStyle | Line style to draw BOS line |

| Show BOS Label | This parameter enables showing a label text on each Break of Structure on the chart |

| Play Sound on MSS or BOS | This parameter will enable playing and alert sound when a market structure event (MSS or BOS) occurs |

| Play Sound File MSS BOS | This parameter will set the file name to be played on sound alert if enabled. This can be set to any .wav file on your computer |

| Order Block | |

| Show Order Blocks | Enable/disable display of Order Blocks |

| This following section is visible only when the Show Order Blocks parameter is enabled | |

| Stop Extending OB @ New Day | This parameter will make the Order Block zones drawing stop from extending into a new day. |

| Allow Mitigation Before Validation | An order block is valid when a specific set of rules are verified. One of those rules is that the price should not mitigate the order block zone. This parameter will enable giving this rule an exception and allow OrderBlock to be valid even though they are mitigated by the price prior to their creation. |

| OB Bullish Color | Sets the color brush to draw bullish Order Blocks |

| OB Bearish Color | Sets the color brush to draw bearish Order Blocks |

| OB Render Opacity (1-100) | Sets opacity used to draw Order Blocks |

| Show Order Block Label | Enable/disable showing the label on each Order Block |

| This section is visible only when the Show Order Block Label parameter is enabled | |

| Order Block Label Size | Order Block label Text Size to be drawn |

| Order Block Label Color | Order Block label Color |

| Order Block Label Opacity (1-100) | Order Block label drawing Opacity from 1 (transparent) to 100 (fully opaque) |

| Play Sound when OrderBlock is created | This parameter will enable playing and alert sound when an OrderBlock is created |

| Play Sound when OrderBlock is mitigated | This parameter will enable playing and alert sound when an OrderBlock is mitigated. Useful if you want to trade OrderBlock pullbacks |

| Play Sound File Order Block | This parameter will set the file name to be played on sound alert if enabled. This can be set to any .wav file on your computer |

| NDOG (New Day Opening Gap) | |

| Show NDOG | Enable/disable display of NDOG zones |

| This following section is visible only when the Show NDOG parameter is enabled | |

| Stop Drawing NDOG @ New Day | This parameter will make the NDOG zones drawing stop from extending into a new day. You can also achieve this by clicking on individual NDOG zones and chose to stop extending them at any given Bar index |

| Stop Drawing NDOG @ New Week | This parameter will make the NDOG zones drawing stop from extending into a new week. You can also achieve this by clicking on individual NDOG zones and chose to stop extending them at any given Bar index |

| Show NDOG 50% Level | This parameter will draw consequent encroachment (50%) on the NDOG zone |

| Show NDOG 75% Level | This parameter will draw Quadrant 75% level on the NDOG zone |

| Show NDOG 25% Level | This parameter will draw Quadrant 25% level on the NDOG zone |

| NDOG Bullish Color | Sets the color brush to draw bullish NDOG zones |

| NDOG Bearish Color | Sets the color brush to draw bearish NDOG zones |

| NDOG Render Opacity (1-100) | Sets opacity used to draw NDOG zones |

| Show NDOG Label | Enable/disable showing the label on each NDOG zones |

| This section is visible only when the Show NDOG Label parameter is enabled | |

| NDOG Label Size | NDOG label Text Size to be drawn |

| NDOG Label Color | NDOG label Color |

| NDOG Label Opacity (1-100) | NDOG label drawing Opacity from 1 (transparent) to 100 (fully opaque) |

| NWOG (New Week Opening Gap) | |

| Show NWOG | Enable/disable display of NWOG zones |

| This following section is visible only when the Show NWOG parameter is enabled | |

| Stop Drawing NWOG @ New Week | This parameter will make the NWOG zones drawing stop from extending into a new week. You can also achieve this by clicking on individual NWOG zones and chose to stop extending them at any given Bar index |

| Show NWOG 50% Level | This parameter will draw consequent encroachment (50%) on the NWOG zone |

| Show NWOG 75% Level | This parameter will draw Quadrant 75% level on the NWOG zone |

| Show NWOG 25% Level | This parameter will draw Quadrant 25% level on the NWOG zone |

| NWOG Bullish Color | Sets the color brush to draw bullish NWOG zones |

| NWOG Bearish Color | Sets the color brush to draw bearish NWOG zones |

| NWOG Render Opacity (1-100) | Sets opacity used to draw NWOG zones |

| Show NWOG Label | Enable/disable showing the label on each NWOG zones |

| This section is visible only when the Show NWOG Label parameter is enabled | |

| NWOG Label Size | NWOG label Text Size to be drawn |

| NWOG Label Color | NWOG label Color |

| NWOG Label Opacity (1-100) | NWOG label drawing Opacity from 1 (transparent) to 100 (fully opaque) |

| RTHG (Opening Range Gap) | |

| Show RTHG | Enable/disable display of RTHG zones |

| This following section is visible only when the Show Opening Range Gap parameter is enabled | |

| Stop Drawing RTHG @ New Day | This parameter will make the RTHG zones drawing stop from extending into a new day. You can also achieve this by clicking on individual RTHG zones and chose to stop extending them at any given Bar index |

| Stop Drawing RTHG @ New Week | This parameter will make the RTHG zones drawing stop from extending into a new week. You can also achieve this by clicking on individual RTHG zones and chose to stop extending them at any given Bar index |

| Show RTHG 50% Level | This parameter will draw consequent encroachment (50%) on the RTHG zone |

| Show RTHG 75% Level | This parameter will draw Quadrant 75% level on the RTHG zone |

| Show RTHG 25% Level | This parameter will draw Quadrant 25% level on the RTHG zone |

| RTHG Bullish Color | Sets the color brush to draw bullish RTHG zones |

| RTHG Bearish Color | Sets the color brush to draw bearish RTHG zones |

| RTHG Render Opacity (1-100) | Sets opacity used to draw RTHG zones |

| Show RTHG Label | Enable/disable showing the label on each RTHG zones |

| This section is visible only when the Show RTHG Label parameter is enabled | |

| RTHG Label Size | RTHG label Text Size to be drawn |

| RTHG Label Color | RTHG label Color |

| RTHG Label Opacity (1-100) | RTHG label drawing Opacity from 1 (transparent) to 100 (fully opaque) |

Download & Installation Instructions

To download and install the indicator follow the instructions below

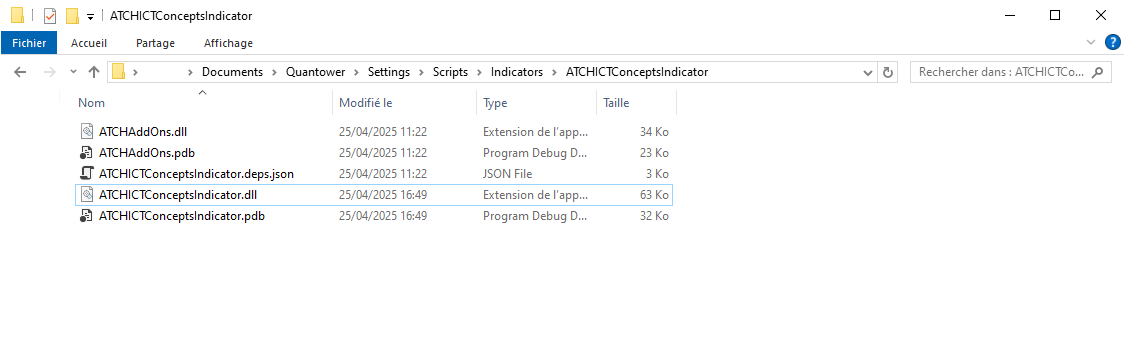

- Click on the below download button to download the Indicator file

- As illustrated on the image below, extract the whole content of the zip file into your Quantower indicators folder. The indicators folder can be found by default following this path : {C:\Users\{Windows Username}\Documents}\Quantower\Settings\Scripts\Indicators

- Make sure the files are extracted inside a new folder called ATCHICTConceptsIndicator

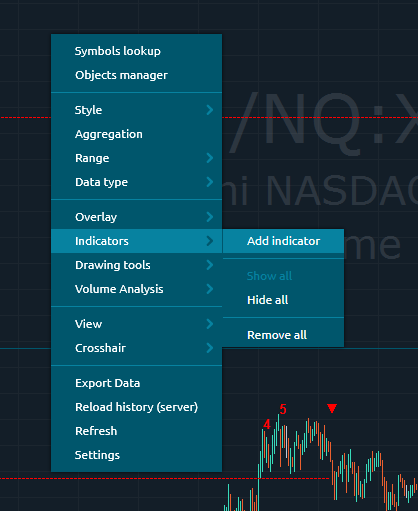

- Next, open a new chart window

- After copying the indicator files and opening a new Chart window you should be able to add the indicator to the chart. Right-click on the chart and click on Indicators -> Add Indicator

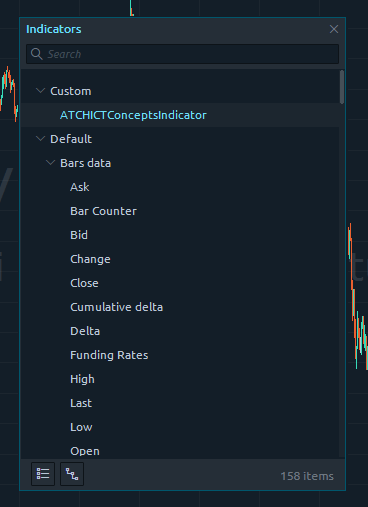

- Then select the Custom/ATCHICTConceptsIndicator entry from the indicators list and Double-Click on it

- After that, you will be able to set the parameters of the indicator in the next panel. At this stage, the indicator should be already added to the chart

- At this stage, you should copy/paste your license number into the License parameter, you can find your license number Here

- If your License was not successfully recognized. You will see an error message on the Chart.

- After adding the indicator to the chart and succesfully submitting your License number, the indicator will be run on Historical data for a couple of seconds

- After this step, the indicator is added with success and will continue to run on live market data

Frequently Asked Questions

General

Yes, If you have an idea that you believe can improve this indicator, I will be more then happy to hear from you. Please use the contact page to send me a message

No, the source code of the indicator is protected for copyright reasons

No, this indicator only do rendering and doesn't provide data that can be used from within a strategy.

Subscriptions Q&A

Yes, you can Cancel/Resume your subscription with a click of a button with no questions asked. You don't even need to request something or send a message. You can manage your subscription in a completely autonomous way.

Our products will verify the license validity at 1st day of each month. At that date, you need to provide the license number to the product (with a simple copy/paste) so that it will be valid to the rest of the month.

We do not store payment credentials, they are encrypted and passed to Stripe or PayPal for a safe & secure way to purchase subscriptions on our site.

Please send us a message from the Contact Page

Release Notes

- First Release of the indicator

User Comments & Feedback

You can find feedback of our users and ask questions about this strategy by joining our discord community by following this invite link or clicking on the Discord logo image. Joining is completely free

![]()